Moves Fleets Program

The call for the MOVES Fleets Program has recently been published in the Official State Gazette (January 19, 2022), aimed at companies operating in several Autonomous Communities.

Basis

Order TED/1427/2021, of December 17, which approves the regulatory bases for the incentive program for light vehicle fleet electrification projects (MOVES FLOTAS Program), within the framework of the Recovery, Transformation and Resilience Plan. Provision 21196 of BOE No. 305 of 2021.

Call for applications

Agency

IDAE

Beneficiary entities

All types of companies with their own legal personality (Micro, Small, Medium and Large Companies), operating in several Autonomous Communities.

The institutional public sector, referred to in Article 2.2 of Law 40/2015 of October 1, on the Legal Regime of the Public Sector.

Eligible Actions (Annex I)

Integral fleet renewal projects will be eligible, which include:

- At least, the “Procurement of electric and fuel cell vehicles” (Action 1).

- Optional: “Installation of electric vehicle recharging points in the parking lots of the applicant company or entity” (Action 2) and

- Optional: “Actions for the transformation of the fleet towards electrification” (Action 3).

Cars and vans (M1 and N1 vehicles) with emissions of more than 50 gCO2/km and L-category vehicles (quadricycles, motorcycles and mopeds) with emissions of more than 0 gCO2/km are not eligible for incentives.

Amount of the subsidy (Annex III)

Total budget of the call for proposals: 50,000,000 euros.

- Performance 1: 500 vehicles per request, as well as a minimum of 25 vehicles per request.

- Action 2: the number of incentivized recharging points may not exceed the number of incentivized vehicles.

- Action 3: a maximum amount of aid equivalent to 20% of the total aid requested is established.

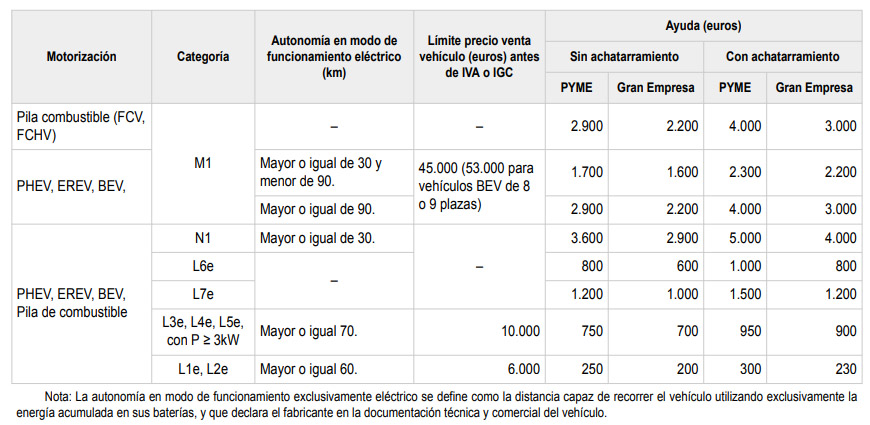

Amount: Annex III of the Order of regulatory bases.

Actions 1: Acquisition of electric and fuel cell vehicles.

Actions 2 and 3:

- The aid intensity will be 40 % of the eligible costs, which may be increased by 10 percentage points in the case of aid granted to medium-sized enterprises and by 20 percentage points if the aid is intended for micro and small enterprises.

- The subsidy will be paid once it has been justified.

Request

2 months from the day following the publication of the extract of the call for applications in the “Official State Gazette” (published on January 19, 2022).

Only projects or actions whose execution begins after the date of registration of the application for aid will be eligible for aid.

Aid Portal of the IDAE’s electronic headquarters (https://www.idae.es/)

Execution

Maximum execution period: 18 months, counted from the date of notification of the favorable resolution granting the aid.

Maximum justification period: three months, counted from the date on which the maximum period granted for the execution of the action expires.

Date of eligible expenses: Only applications for projects whose execution has not begun prior to the date of registration of the aid application will be accepted.

Resolution

6 months, counted from the date of application.

Documentation to be submitted

Documents established for the application in the Order of regulatory bases:

- Aid Application Form: A model will be provided at the IDAE’s electronic headquarters.

- Photocopy of the DNI, for Spanish citizens, or of an equivalent document that certifies the identity of foreigners and in which the NIE appears.

- Legal persons, public or private, and other entities, with or without legal personality, in addition to what is established in the previous section, must provide documentation accrediting the powers of representation of the person.

- Certificate from the Commercial Registry or, failing that, power of attorney. In either case, the signatory of the aid application must appear as the representative of the company.

- Tax identification card (NIF).

- Documentation that accredits the inscription in the census of Businessmen, Professionals and Withholders.

- For Medium and Small Companies, accreditation of such status, according to the definitions contained in Article 3 of Annex I, of the EU Regulation n.No. 651/2014, of the Commission, of June 17, 2014, by providing a Responsible Declaration signed by the representative of the company specifying: the turnover and annual balance sheet figure resulting from the annual accounts of the applicant company and of the associated or related companies, corresponding to the last closed accounting period, and which have been deposited in the corresponding Register, the number of employees of the company, as well as those of the associated or related companies and the qualification as an autonomous company, or indicating the associated or related companies including the respective participation data. A model will be provided at the IDAE’s electronic headquarters.

- Descriptive report of the actions in accordance with the format and model available on the IDAE website, www.idae.es.

- Documentation accrediting that they are up to date with their tax and Social Security obligations, when the amount of the aid exceeds 10,000 euros per recipient.

- Responsible declaration, according to the model in Annex II of the Order of bases, that accredits the fulfillment of the necessary requirements established to acquire the condition of beneficiary.

- Self-assessment questionnaire on compliance with the principle of “no significant harm” to the environment within the framework of the Recovery, Transformation and Resilience Plan (PRTR), in accordance with the annex of the Guide for the design and development of actions in accordance with the principle of no significant harm to the environment, duly completed. Model link.